I know some folks are interested in the meeting from this week. I’ll put together something more coherent after thinking and talking with more people, but for now here are my rough notes – comments, queries, and corrections welcome:

Meeting Dec. 28 at City Hall, council work chambers, attendance: Jennifer Lane, Ed Soph, Carol Soph, Theron Palmer, Elida Tamez, Adam Briggle, Ken Banks (COD sustainability), Jim Maynard (DME), Katherine Barnett (COD sustainability), Phil Williams (DME).

Initial discussion focused on GHG implications of the plan with the aid of a new excel spreadsheet that can be made public. Data on the sheet come from either EPA EGRID (city has used this database since 2006) or from specs of the proposed RICE plants (guaranteed maximum emissions – it will likely perform better). I think sometimes data come from measurements at individual power plants.

The spreadsheet showed overall GHG emissions are reduced by 74% with the plan vs. status quo.

There is still an emissions reduction (I think they said 48%) even if we account for the additional generation for sale on the ERCOT market, which is a form of double-counting emissions.

ERCOT market sales from the proposed RICE plants will not displace solar or wind, because they have zero fuel cost and the stack is set by fuel cost (lowest comes online first).

The ERCOT market sales from the proposed RICE plants will displace some coal but mostly natural gas from less-efficient and more –polluting sources, mostly to the south and east of us.

There was another spreadsheet from the same data sources that showed how the proposed plan would reduce our overall consumption of natural gas by 37%. This spreadsheet too can be made public.

Other utilities are building plants like these, including some in south Texas and golden spread in the panhandle, which has 170 MW from these plants and has just switched into the ERCOT market to track with wind similar to the proposed plan by DME.

The conversation the focused more on the local air quality impacts of the proposed plan. There was some indication that outside consultants were used for help with air permitting – I didn’t get the name of the company, the woman mentioned was something like Mary Hauner-Davis(?). A claim was made that the proposed RICE plants are equivalent to 1% of on-road emissions in Denton County.

Denton has poor air quality in large part due to emissions from south and southeast – power plants, cement plants, and on-road sources.

When we purchase electricity from the market, it mostly comes from the south and southeast – the places that impact our air quality. So, producing that electricity here will displace emissions that would have otherwise come downwind of us. NOx impacts will be minimal in part because it will dissipate and move north before forming ozone. And also in large part because these proposed RICE plants are roughly 9x more efficient (emit 9x less NOx than the market average gas plant) – this claim came from another data source that I will also see if we can get publicized. Electricity generation in DFW ten county area emits 5,482 tons of NOx. The proposed RICE plants would emit 40 tons. Electricity generated by them for Denton will displace the coal plant and electricity generated by them for ERCOT market sales will displace these dirtier gas sources.

They have consulted Dr. John at UNT – he didn’t think there would be a noticeable change at Denton monitor, but there would be additional ozone precusors heading to the north.

TCEQ treats this as a minor (non-major) source.

At any point a new business/industry could move to Denton and produce this amount of emissions with a standard application through TCEQ. It would not require a public dialogue or vote and would not come with the increased renewables. And Denton cannot effectively regulate this as it is preempted on air quality issues.

Why not more solar now? If we go all in on solar now, we are too soon – the technology is developing rapidly so we want to wait a bit to get better technology over the coming years – we want to add new solar and/or batteries to accommodate Denton’s growing demand over the next 40 years. The idea is that all new demand is met with renewables and that we increase our overall percentage of renewables up to 100% by 2030.

Georgetown has 100% but that means in the sense that they buy enough electricity to cover their megawatts, but it doesn’t all come at the right time so they buy back up that is natural gas, dirtier than the proposed RICE plants, more expensive, and not under their control.

The ideal is to go 100% with batteries charged by all renewables. Forecasts they have heard and read show us being at least twenty years away from that and likely longer. Elon Musk has a stated goal to displace 10% of electric generation in 20 years.

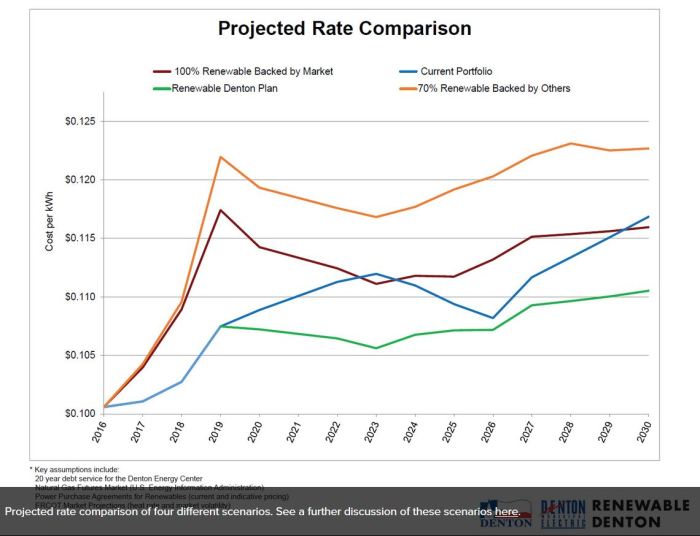

DME rates have averaged 10% to 15% below market rates over past 15 years – DME is an at-cost provider – this was from a website called something like power achieve??

There was a good deal of discussion both about Green Sense and reducing demand/ working on conservation efforts. General acknowledgement that that too is important, especially for the key accounts (top 127 meters account for 40% of total electricity usage). But a sense also that getting to 100% via Green Sense is going to take a very long time. A claim was made that if all 45,000 customers residential got solar it would cost $720 million and would still require the gas plants as back up.

On Gibbons Creek still operating – it is like trading in your older, dirtier car for a more fuel-efficient one. Just because someone still drives your old car, does not mean you are responsible for those emissions. And in this case, we will be driving dirtier megawatts from other plants off the market, meaning very real emissions reductions.

A claim was made that 70% is the minimum renewable level sought by 2019 with the plan and that it would maybe be closer to 80%.

Due to interest rate increases (I think) deliberation about the plan has already increased its price by $10 million.

DME requires some confidentiality or else it will always be at a competitive disadvantage.

If 5,000 MWh of coal-fired electricity was shut down east and south of us at 130,000 tons of NOx that would only move the needle on our local ozone down by 1 ppb – this from Dr. John.

Some things I think we forgot to ask or could have done better on: notification for residents near the sites for the proposed RICE plants, the possibility of community aggregation, emphasizing more data for health impacts or air dispersion models.